Paul's Success Story

How Paul transformed his financial future with MoneyChoice

Read StoryGet ready for the mobile experience you've been waiting for!

Gold Members: 100+ Predictions Daily - Upgrade Now!

As of January 1, 2025, MoneyChoice has fully acquired TINO IQ

Unlike traditional indicators that tell you "What happened," our algorithms predict "What should happen." Think of each IQ as a specialized lens revealing hidden market patterns invisible to others.

Revolutionary approach to identifying extreme market conditions. Unlike traditional methods, our algorithm predicts when oversold stocks will reverse, providing optimal entry points.

Identifies stocks with strong momentum potential and predicts continuation patterns. Captures the energy of market movements before they become obvious.

Measures the strength of bullish and bearish sentiment in real-time. Identifies when market participants are willing to commit significant capital.

Tracks the flow of capital into and out of stocks. Identifies when smart money is accumulating or distributing positions.

Analyzes mass psychology and emotional responses to news and events. Identifies when crowd sentiment creates trading opportunities.

Real-time news analysis that predicts market impact. Saves hours of research by automatically analyzing news sentiment and historical stock reactions.

Reverse engineers insider trading patterns to uncover hidden opportunities. Identifies when company insiders are making significant moves.

Our multi-lens analysis examines market psychology from multiple perspectives

Our daily process of scanning thousands of stocks and validating patterns

Artificial manipulation occurs when stocks are artificially pumped up, creating an illusion that a particular stock is the best investment. Once retail investors start buying, the stock drops dramatically, leading to significant losses.

Our advanced algorithms analyze trading patterns, volume spikes, and behavioral indicators to identify signs of artificial manipulation before it becomes obvious to the market.

When we detect manipulation, we assess if there's a profitable trading opportunity. If yes, we calculate the safe trading window and provide it to our members as a trading opportunity.

Two decades of innovation in financial technology and market analysis

Began analyzing various factors impacting the market, laying the groundwork for our proprietary algorithms.

Established with a mission to revolutionize market analysis through advanced algorithms and behavioral psychology.

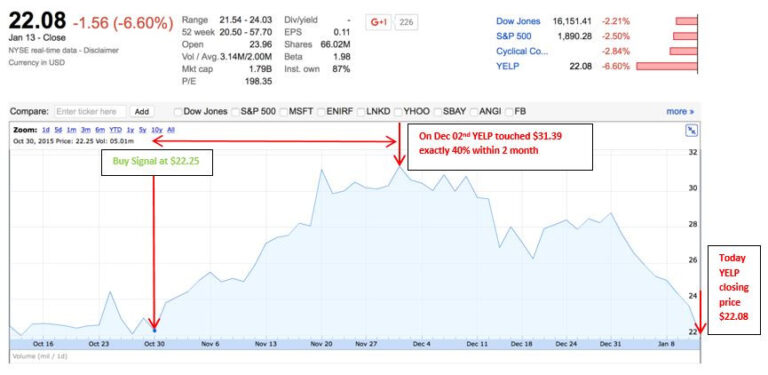

Our behavioral analysis identified artificial manipulation in YELP stock, leading to a 40% profit opportunity.

Achieved consistent prediction accuracy of over 80%, a benchmark we've maintained ever since.

Successfully launched our mobile application, attracting thousands of users.

TINO IQ signed a $150M deal with 2 Ex-Goldman Bankers for proprietary usage.

Multiple hacking attempts to access TINO IQ's algorithms forced us to shut down the app temporarily to protect our proprietary technology.

Rebuilt our infrastructure with advanced security architecture performing 80 billion computations daily.

Successfully completed the full acquisition of TINO IQ, integrating advanced institutional-grade financial analysis and trading solutions into our platform.

Successfully restarted our application with a robust, secure foundation built on years of experience.

Learn from our strategies, insights, and real success stories from our community

Learn the fundamentals of using our proprietary algorithms for profitable trading

Read ArticleDiscover why quantum physics should be used in understanding stock market behavior

Read ArticleUnderstanding the role of trusted financial advisors in modern investing

Read ArticleMy personal journey to financial independence and the strategies that changed everything

Watch VideoThe breakthrough moment that freed me from the 9-to-5 grind forever

Watch VideoProven techniques to dramatically improve your option trading win rate

Watch Video